Stanbic Bank has partnered with the Zambia Credit Guarantee Scheme (ZCGS) to extend more credit to Micro Small and Medium Enterprises (MSMEs) in the country to boost economic growth.

The MoU agreement symbolizes Stanbic and the ZCGS’s joint effort to remove barriers that have historically hindered MSMEs from accessing affordable financing.

“MSMEs in Zambia contribute 70% of Gross Domestic Product (GDP) and 88% of employment,” said Stanbic Chief Executive, Mwindwa Siakalima, in a statement to RCV News in Lusaka.

Mr. Siakalima said the MoU will now enable the Bank to extend more credit to the MSME sector to stimulate further economic growth.

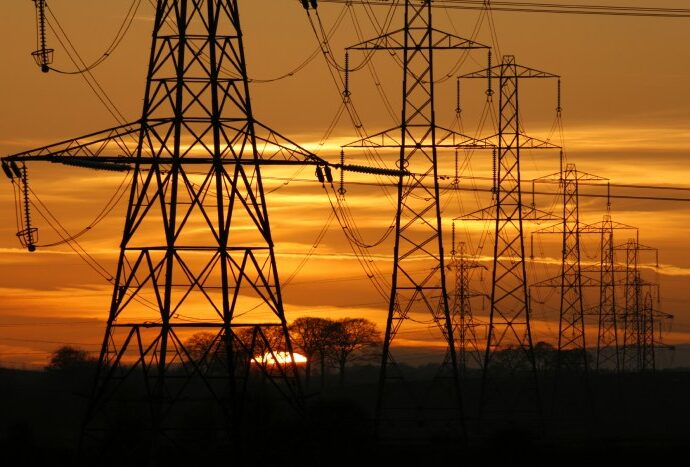

He said with the current energy crisis, Stanbic is confident that the selected MSMEs playing in the renewable energy sector will be adequately supported to alleviate the pressures businesses are facing due to the load shedding impact.

ZCGS Chief Executive, Mary Mumba said with improved access to finance, MSMEs will be better positioned to invest in their operations, expand their businesses and create jobs.

“This is especially important for entrepreneurs, who have the vision and determination to grow their businesses but have faced challenges in securing loans due to lack of collateral or credit history,” said Ms. Mumba.

Meanwhile, Director Planning and Information in the Ministry of Small and Medium Enterprise Development, Mr. Nicholas Chikwenya said the initiative will open new doors for SMEs, providing them with the financial support they need to scale up their operations, invest in innovation and create new employment opportunities.

By Margaret Mwanza